How to Give Your Credit Score a Boost

When it comes to credit, you should know the score. Your credit score, that is. A credit score is a three-digit number from 300 to 850 that serves as a snapshot of your credit report at any given time.

“The higher the number, the less likely you are to go delinquent on your accounts in the next 90 days,” Sjoblad says. Lenders often just look at your credit score rather than wade through your entire credit report to determine if you’re a credit-worthy risk. You get better rates with higher scores.

Take a peek. Who gets to see this magic number? You can look at yow own score. So can lenders preparing to offer you a loan or companies about to offer you credit. Your employer might even sneak a peek.

“Sometimes employers will take a look at the score to see if you’re a risk to be handling their company’s money, especially if you’re applying for an accounting job or something like that,” Sjoblad says. “They might take a look at you and see if you’re responsible with your own money. Then you’ll probably be responsible with your company’s money.”

But no one else can look at your score without permission. Make that scores. You actually have three credit scores, one from each of the three major credit bureaus.

“A lender is not required to send information to any of the bureaus, let alone all three of them. Information from the bureau level can be slightly different, and so your FICO scores can be different,” Sjoblad says, “If you’re getting ready to

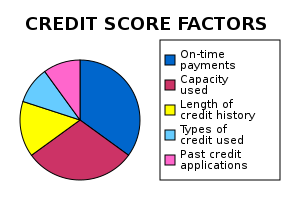

Factors contributing to someone’s credit score, for Credit score (United States). (Photo credit: Wikipedia)

apply for a loan, it’s always a good idea to check all three scores.”

To do this easily, all in one place. The median credit score is 720. That should be high enough to qualify you for the lowest rates — but it depends on each lender’s own cutoff.

Learn the recipe. What goes into a credit score? “It’s solely from information that’s available in your credit report,” Sjoblad says. “Factors that don’t go into your score are things like income, age, race, sex, location, that sort of thing. Those things do not factor into the score.” Now, here’s what does factor into your credit score.

- Payment history, the biggest factor, comprises 35 percent of your score. “How you paid in the past is a good indication of how you’re going to pay in the future,” Sjoblad says.

- Amount owed counts for 30 percent. This includes all your balances on your credit cards. “For example, if you have a whole bunch of credit cards that are near maxed out, that’s not going to factor as well as if you have a $100 balance on your credit cards and you paid it off at the end of the month,” Sjoblad says.

- Length of credit history is worth about 15 percent. “It makes sense that somebody just coming out of college or just coming into the workforce and has no length of credit history might be a bigger risk than somebody who has been out for a while and has established a long credit history,” Sjoblad says.

- New credit counts for 10 percent. Applying for new credit in the past 60 to 90 days has the biggest effect. “If people are going out and all of a sudden getting six, seven, eight new credit cards all at once, it may be an indication that something might be going on with them financially. You kind of keep an eye on that. It may lower your score,” Sjoblad says.

- Types of credit used makes up the final 10 percent. You want a healthy mix of credit. “Somebody who has, for example, a mortgage, an auto loan, and maybe two or three credit cards, that’s a pretty good, responsible use of credit,” Sjoblad says. “Somebody who has no mortgage, no auto loans, and 25 maxed-out credit cards, for example, shows less responsible use and that may factor into your score.”

Improve your score. If your credit score seems a little low, don’t worry You can take steps to correct that.

- Pay your bills on time.

- Pay down the balances, especially on credit cards.

- Take out credit only when you really need it.

Category: Credit Score